What is the right trend?

The relativity of the trend and the correct chart analysis

Reading Time: 3 minutes

Post published on 22/07/2021 by Fabrizio Cesarini on site https://www.fabriziocesarini.com and released with licenza CC BY-NC-ND 3.0 IT (Creative Common – Attribuzione – Non commerciale – Non opere derivate 3.0 Italia)

Cover Image credits and copyrights by Isaac Smith on Unsplash

Article Images credits and copyrights by Fabrizio Cesarini on https://www.fabriziocesarini.com

Have you ever had to make an investment? From choosing the best service provider for your business to choosing a brand of shampoo … we practically do it all the time, in all the activities that affect us on a daily basis, at work as well as in our private lives. Even more so when it comes to making financial investments!

In these cases, first of all, the simplest and most intuitive way to understand the behavior of an asset is to learn how to read its chart. Yes, the chart … but which chart?

It sounds simple but depending on the period of analysis we take into consideration, the analysis can often lead to completely different results thus putting us in doubt about the correct choice to make.

So how do we resolve this issue? By setting our investment goals first!

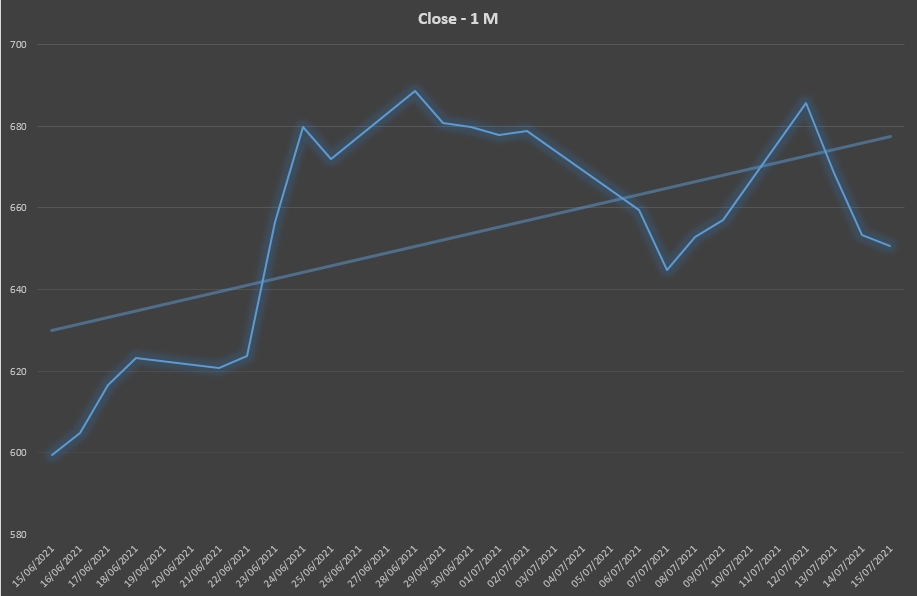

Let’s take an example and try to analyze the trend of the Tesla stock (TSLA). For this purpose, we retrieve historical data and create the corresponding chart. To facilitate our initial assessment of the trend, we also report the trend line.

Below we report the chart relative to the trend of the closing price respectively of the last year as in Figure 1:

of the last 6 months as in Figure 2:

and the last month as in Figure 3:

As is evident, the three situations are contradictory to each other. Depending on the period of analysis, the situation changes, both in terms of intensity of trend direction and direction itself, going from an increasing trend then to a decreasing one to return to an increasing one.

So what is the correct trend? Who is right?

In order to understand which is the most correct time period for our initial analysis we must always first consider our investment objectives. So a more cautious attitude will be based mainly on long or medium term analysis. A speculative attitude instead will have to continuously refer to much shorter time periods.

In conclusion, it should not seem anomalous that the results may be discordant as the analysis must be contextualized to the period of observation and the latter to the investment goals.

I hope this simple article can be of help to you.

If you liked it share it with your contacts that you think may appreciate it and follow me on Linkedin.